Please select your location and preferred language where available.

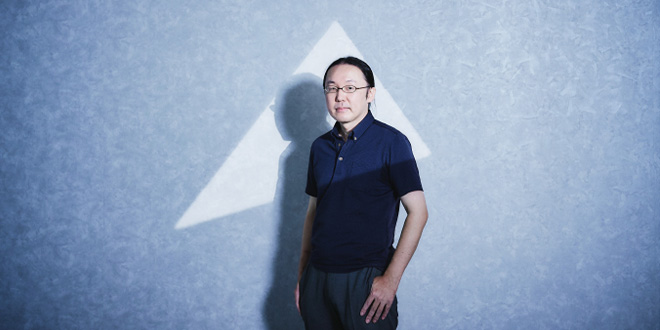

[Michiaki Tanaka - View]

Unexpected B-to-B Tech Trends Produced by Privacy Protection

- Researcher of Platformer strategy Michiaki Tanaka speaks about new trends in B to B technology -

Michiaki Tanaka, a professor at Rikkyo University’s Business School, is well versed in the strategic research of global tech companies such as the GAFA group (Google, Amazon, Facebook and Apple). Amid the spread of AI, IoT and other technologies, which companies will take the lead in 2020 by capturing the trend? We asked Professor Tanaka to analyze the mega trends in the tech industry, as well as the industries and players that are likely to grow in line with the trend.

Common features of tech leaders

──Prof. Tanaka, you have been engaged in strategic research on global tech companies for a long time. What do you think strong global tech leaders have in common?

Tanaka: I think there are three main points.

Professor, Rikkyo University’s Business School (Graduate School of Business Administration)

President and CEO, Merging Point Co., Ltd.

First, they focus on the end-user customer experience. Second, they have formed an ecosystem of peers and built a platform. Third, their PDCA (Plan-Do-Check-Act) execution is extremely fast, even among large-sized companies. No matter how large the GAFA companies grow, their management speed has not slowed down.

In the B-to-B tech industry, the first point, customer experience, is most likely to be overlooked. B-to-B companies tend not to focus too much on end users because they are the customers of their customers, but without the success of end users, B-to-B companies cannot be successful.

I think one of the reasons why Amazon’s AWS cloud is successful is that Amazon itself is a user of cloud services, and the company designs AWS based on its understanding of the needs of end users.

──In addition to the three points you mentioned, how do you see the trends of 2020, as technologies such as AI and IoT continue to evolve and spread?

I visit CES (Consumer Electronics Show) which is held in Las Vegas every year for research.

As its name suggests, it was originally an exhibition of consumer electronics. However, as of several years ago, it has become a place where the world’s leading companies show off their cutting-edge technologies, regardless of whether they are business-to-consumer or business-to-business companies. So, we can learn a lot from going there.

The trend that struck me at CES this year was the arrival of the “age of privacy.”

In recent years, regulatory action on the use of personal data has been accelerating in the EU, but the U.S. is also rapidly moving toward privacy, partly because of privacy violations on Facebook.

In California, the California Consumer Privacy Act (CCPA), which applies to all businesses, went into effect on January 1, 2020. The scope of the new act is broader than that of the Personal Information Protection Act of Japan and carries heavier penalties for violations.

Under these circumstances, the most high-profile session at CES this year was a roundtable session among chief privacy officers (CPOs).

The CPO of Facebook, which has been at the center of privacy issues, and the CPO of Apple, which normally doesn’t show up at these exhibitions, attended the roundtable. The roundtable was also attended by the commissioner of the Federal Trade Commission (FTC), which is equivalent to Japan’s Fair Trade Commission. This is why the roundtable attracted a lot of attention.

In the future, Internet services will be evaluated based on attitudes and efforts to protect the privacy of end users. That’s why the CPOs of renowned companies attended the roundtable to promote their efforts, and the session attracted a large audience of people who were keen to hear what they had to say.

I think that Apple is the most pro-privacy company in GAFA, or among the world’s top players. However, the CES roundtable highlighted the fact that even Apple’s efforts are not enough. I got the strong feeling that the world is beginning to demand an even higher level of privacy.

I feel a sense of crisis about this in Japan. The situation in Japan is very different from the situation in the U.S., and information banks have finally become a topic of conversation. In the first place, Japan’s use of data is behind other countries, and it is undeniable that Japan lags behind the U.S. in terms of privacy values and relevant laws and regulations.

Edge computing attracting attention due to privacy

──What are the latest trends in an era where the commitment of companies to the protection of privacy is scrutinized?

Edge computers, and their component modules, will get even more attention.

──Will privacy drive demand for edge computing?

Apple keeps your iPhone data on your iPhone as much as possible and doesn’t transfer it to the cloud. That’s because Apple doesn’t want to bring personal data into the company.

Edge computers are computers owned by users, such as smartphones and personal computers, and edge computing, a derivative of the term, means processing data on the user’s computer. It is attracting attention as a technique to eliminate the load and communication delay on higher systems such as clouds and servers, but I think the need will increase from the viewpoint of privacy.

──So you think that having data on the device side is not just about load balancing in the cloud, and that the need for edge computing will increase also from the viewpoint of privacy?

Yes. If a company doesn’t collect data, it can’t invade users’ privacy. Businesses will have more digital contact points with users and it will become easier for businesses to access users’ data. It’s a valuable asset for satisfying users’ needs, but it could also become a risk if it is misused.

GAFA have a strong presence in semiconductors

──Which B-to-B tech industries will grow further as edge computing gets more attention?

I think the demand for data processing on the edge side will increase, so semiconductors for AI are promising. While NVIDIA and Intel have taken the lead globally, service players like Apple, Google and Amazon are starting to build their own chips for AI. Even in the field of semiconductors, we cannot take our eyes off GAFA.

And the demand for memory will increase. This is basically a commoditized space, but as a differentiator, there are promising fields such as AI, IoT, automation, edge computing and 5G. Memory manufacturers will be able to make their presence felt if they can deliver products that fit these growing segments.

In addition, the speed of access to memory is becoming a bottleneck in overall processing amid the growing demand for greater computing power. So an increase in access speed is another factor for overcoming the competition.

──Memory, as you say, is a commodity product that has undergone a series of global restructures and its industry map has been redefined. Japanese semiconductor companies have also suffered, caught up in this maelstrom.

Toshiba Memory Corporation, which had made its presence felt in this situation, left Toshiba’s hands and changed its name to “KIOXIA” to make a new start. What do you think of this move?

A quick lesson on memory

Memory is roughly divided into volatile memory, which loses data when power is disconnected, and nonvolatile memory, which retains data even without power.

SRAM and DRAM are examples of volatile memory. Currently, DRAM, which is cheaper than SRAM, is widely used as the main memory of a computer.

Various kinds of nonvolatile memories such as EPROM have been developed. Flash memory is now widely used for computer and smartphone storage because of its low cost, high capacity and high performance.

KIOXIA has the second largest share of the worldwide flash memory market. Since Toshiba invented NOR flash memory and NAND flash memory in the 1980s, the company has gone on to lead its technological development. The current mainstream in memory is three-dimensional [3D] flash memory, in which memory cells are stacked. The company is also developing various next-generation memories.

Well, since I value the importance of corporate missions, I looked at their mission in detail. Frankly speaking, I’d give them high marks on their mission.

──Their mission is “Uplifting the world with ‘memory,’ ” isn’t it?

Specifically, they explained, “When we say ‘memory,’ we mean much more than simply recorded data. To us, it represents the comprehensive collection of emotions, experiences and ideas beyond digital information gathering. As KIOXIA, we will create new value in the memory space.” They said it represents the comprehensive collection of emotions, experiences and ideas, so if KIOXIA can develop businesses and products to realize that, it will be a big differentiator.

KIOXIA’s mission and vision

<Mission>

Uplifting the world with “memory”

By evolving “memory,” we create uplifting experiences and change the world.

<Vision>

With progressive memory technology at our core, we offer products, services, and systems that create choice and define the future.

The world of “big data x AI” has already begun to completely cover the five senses of humans, the physical senses.

Substituting the senses with technology means a variety of sensors, including light, sound, temperature, humidity, pressure, electricity and magnetism. It will be beneficial for KIOXIA to work with manufacturers of electronic devices, especially sensor component manufacturers, to create new value by combining their efforts multiplicatively.

For example, has the drifting scent of a sweet olive tree ever hit you with a wave of nostalgia, triggering access to old memories? The sense of smell has direct access to areas such as the amygdala and hippocampus, which deal with memory and emotions, so floral scents often evoke memories. If that’s important, KIOXIA should work with an olfactory sensor company.

In the U.S., use cases are said to be the key to technology. We might say that the growth strategy to realize KIOXIA’s mission is to form an open platform, together with players who can show use cases of memory, including experiences.

It is interesting that a company that has been in charge of infrastructure “points” in semiconductors has focused its mission on people in memory, and I think it’s an extremely good fit for this time in history. It’s a tall hurdle, but I hope to see good results from them. I think it’s a promising mission.

When it comes to memories and experiences, you have to think about what kind of experience value you will provide to end users, so I think it will be difficult without a truly customer centric perspective. I think KIOXIA’s mission is a sign of that determination.

Michiaki Tanaka

Professor, Rikkyo University’s Business School (Graduate School of Business Administration)

President and CEO, Merging Point Co., Ltd.

Prof. Tanaka obtained an MBA at the University of Chicago Graduate School of Business. He specializes in corporate strategy, marketing strategy, mission management, and leadership. He has served as a Researcher at the Investment Banking Division at Bank of Tokyo-Mitsubishi UFJ, Transactor (Vice President) at the Asset Securitization Department, Citibank Japan, Head of Structured Finance (Principal) at Bank of America Securities-Japan, and Head of Origination (Managing Director) at ABN AMRO Securities (Japan), and is now teaching at Rikkyo University as a professor while serving as President and CEO of Merging Point Co., Ltd., a management consulting firm that he established. He is the author of a number of publications including The World in 2022 as Envisaged by Amazon, Next-generation Automobile Industry in 2022, Predictions of the World of 2025 Using Softbank as a Barometer (PHP Institute, Inc.), GAFA x BATH--Competitive Strategies of Tech Giants in the U.S. and China (Nikkei Publishing, Inc.) and The Day Amazon Bank Will Be Born: Next-generation Financial Scenario for 2025 (Nikkei Business Publications, Inc.).

Interview and editorial: Takeshi Kimura

Composition: Norihiro Kato

Photoshoot: Kazushige Mori

Design: Kyosuke Tsukimori

The content and profile are current as of the time of the interview (March 2020).